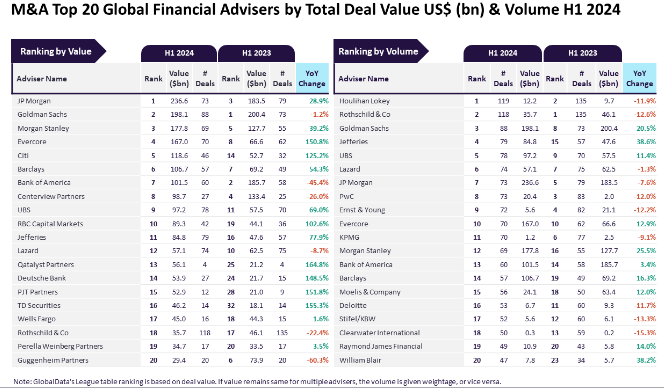

According to GlobalData’s latest Financial Advisors League Table, JP Morgan and Houlihan Lokey have been recognised as the leading merger and acquisition (M&A) financial advisors globally for the first half (H1) of 2024, ranking highest in deal value and volume, respectively.

GlobalData analyst Aurojyoti Bose believes the involvement in big-ticket deals helped JP Morgan to register growth in terms of value and occupy the top position by this metric.

Bose said: “JP Morgan registered significant improvement in the total value of deals advised by it during H1 2024 compared to H1 2023. It was the only adviser to surpass $200bn during the review period. JP Morgan advised on $44bn deals during H1 2024 that also included seven mega deals valued at more than $10bn.”

She also noted that Houlihan Lokey was one of only two advisors to achieve triple-digit deal volume in H1 2024. Despite leading in volume, Houlihan Lokey faced tough competition from Rothschild & Co, which she added missed the top spot “by a whisker.”

Rothschild & Co secured the second spot in deal volume, advising on 118 transactions, followed by Goldman Sachs with 88 deals, Jefferies with 79, and UBS with 78.

In terms of deal value, investment banking firm Goldman Sachs ranked second, advising on $198.1bn worth of transactions. Morgan Stanley followed with $177.8bn, Evercore with $167bn, and Citi with $118.6bn.

Fashion brands and investment companies are continuing to use mergers and acquisitions (M&A) to rescue financially struggling firms and strengthen their portfolios.

Earlier this month UK retail conglomerate Frasers Group increased its investment in German luxury brand Hugo Boss as part of its wider aim to bolster its luxury portfolio.