GlobalData’s Geopolitics: Executive Briefing report revealed the uncertainty created by geopolitics is influencing consumer perceptions of brands and their trustworthiness. As a result, consumer choices are being impacted by geopolitical tension.

Christopher Granville from GlobalData TS Lombard said in the report: “Geopolitical risk has historically tended to be remote from day-to-day business concerns. This is no longer the case.”

The apparel industry is not stranger to experiencing disruptions and challenges stemming from geopolitical factors such as conflicts, trade policies, and political instability. These variables significantly affect consumer demand, operating costs, supply chains, and sourcing decisions within the apparel sector.

Geopolitical impacts consumers’ behaviours, attitudes

GlobalData’s report pointed out that geopolitical events can create a “ripple effect” that influences economic conditions, consumer confidence, and cultural dynamics.

The report explained: “In a global economic environment already characterised by high inflation and residual supply chain disruptions post-pandemic, events such as the conflict in Ukraine and ensuing economic sanctions only exacerbate market instability.

“This in turn influences consumer confidence by creating fear and uncertainty about the future, which can result in more cautious spending. Major global events can also trigger shifts in public opinion and values, which shape the products and brands that consumers find appealing or socially acceptable.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe report also argued that consumer choices are not solely dictated by individual needs and product characteristics but also by brand perceptions and the extend to which a brand “accurately reflects individual values.”

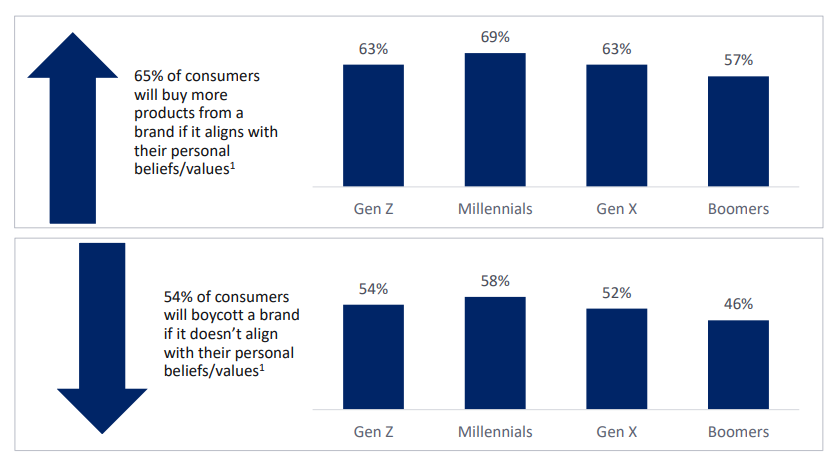

GlobalData’s report found that almost two-thirds (65%) of consumers will buy more products from a brand if it aligns with their personal beliefs and values, a sentiment that is particularly pronounced among millennials (69%).

Consumers are also willing to abandon a brand for similar reasons, with a majority (54%) prepared to boycott a brand if it diverged from their personal beliefs.

Illustrating this point, the report references the Russia-Ukraine conflict, emphasising the emergence of “collective resistance” towards brands and products originating from Russia.

Similarly, it states that the conflict in Gaza has prompted consumers on both sides to express their discontent through targeted boycotts against global brands perceived to have affiliations with the conflict.

Geopolitical theme peaked in March 2024

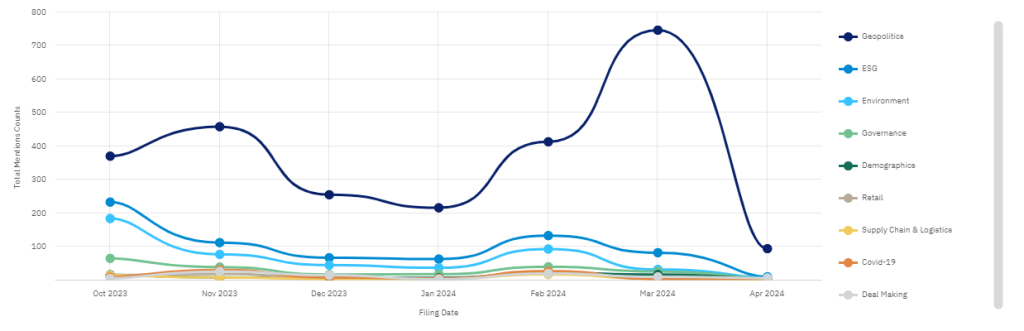

Geopolitical concerns were the most-cited theme in the apparel sector’s company filings between October 2023 to April 2024.

The theme mentions peaked in March 2024 with geopolitical being cited 747 times.

This stands true as the fashion industry seems to grapple with burgeoning crises one after the other. From the Red Sea crisis leading to shipping delays and additional costs for fashion brands and retailers, to the third year of the Russia-Ukraine conflict driving up energy prices, and the lingering inflation impacting global economies and squeezing consumers’ discretionary income.

M. Fatih Bilici, vice president of the Istanbul Textile and Apparel Exporter Association (ITHIB), told Just Style recently that attacks in the Red Sea also had an impact in Türkiye. Despite sourcing raw materials like cotton locally, he said that Türkiye also imports from the US, leading to increased delays due to disruptions in transportation.

In another conversation with Just Style, Yazan Zubeidi, managing partner at Jordanian Modern Textile, an Amman-based manufacturer of casual knitwear for men, women, and children, disclosed that domestic sales of clothing and textiles in Jordan have plummeted by at least 40% since the onset of the Israel-Gaza conflict.

“This drop can be attributed to several factors, including consumer reluctance to make purchases in solidarity with the people of Gaza, the cancellation of almost all events, celebrations, and campaigns, and the sharp decrease in tourist numbers,” said Zubeidi.

Moreover, the data from the Office of Textiles and Apparel (OTEXA) is evidence of how geopolitical issues are plaguing the apparel industry currently, with apparel imports from all sources falling 22% year-on-year in 2023 to 24.3bn square metre equivalents (SME).