Stocklytics.com points out the fashion industry has picked up its pace of growth following a lull over the past two years after inflation caused a cut in consumer spending.

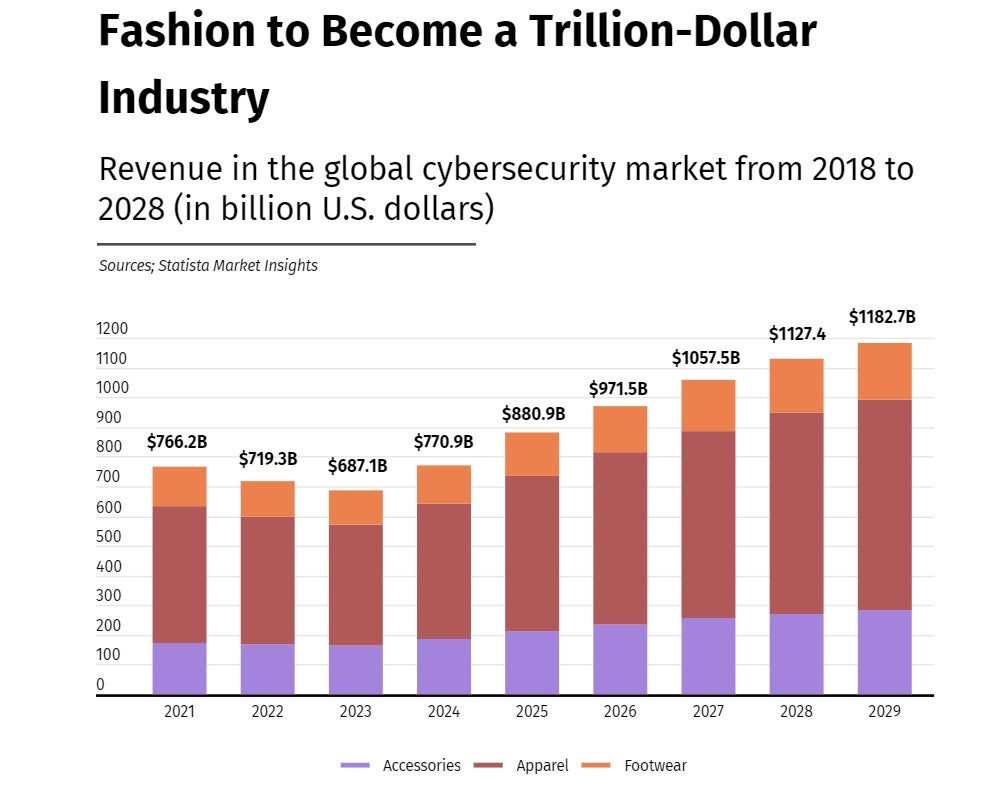

Citing Statista data, stocklytics.com says that by the end of 2024, shoppers worldwide will spend $770.9bn on fashion, or $83bn more than last year. Statista expects consumer spending in the fashion industry to continue growing by an average of $90bn per year, helping the entire market reach a massive milestone and become a trillion-dollar industry by 2027.

Almost 60% of that value will come from apparel sales, the market’s largest and highest-grossing segment. Revenue in the apparel market is forecasted to grow by 38% and hit $631bn by 2027. The accessories market will see practically identical growth, with revenues reaching $255bn in the next three years. Global footwear sales will generate $170bn by 2027, or 32% more than this year.

The report adds China and US will remain the largest markets in the fashion industry generating more than half of the total revenue.

The revenue in the Chinese fashion industry will grow by nearly 40% and hit $323bn in the next three years. The United States follows with a 34% growth in this period and $265bn in revenue by 2027.

The findings echo those found by GlobalData which said while consumer appetite returns, there will be a conservative approach to spending that will “remain ingrained” and consumers will continue to prioritise quality over quantity.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCapsule wardrobes will be favoured over fast fashion while spending will also continue to be diverted into the resale market as shoppers seek out bargains.

For brands, capturing growth will come from using direct-to-consumer strategies and leveraging online channels. Online penetration is set to grow from 26.9% in 2023 to 29.3% in 2028.