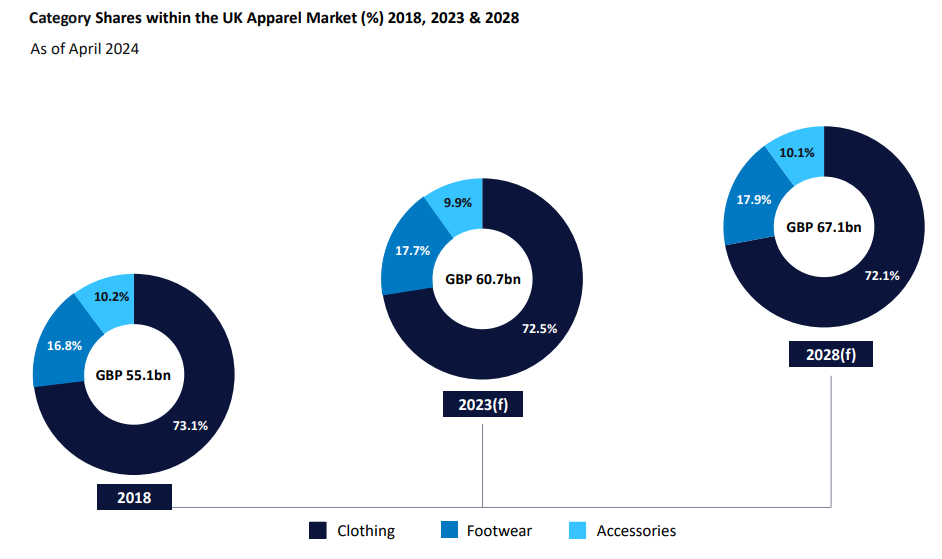

The Apparel Market in the UK to 2028 report published by GlobalData observed that the fashion accessories segment is expected to record the strongest growth between 2023 and 2028, rising 12.7% to £6.7bn ($8.4bn).

The fashion accessories market share is expected to rise 0.2ppts to 10.1%, however, it will remain below 2018 levels as it is considered less essential than clothing and footwear so more susceptible to consumer cutbacks.

Footwear is expected to outperform between 2023 and 2028, with its share rising by 0.2ppts to 17.9%. The report noted that growth in the sector has been supported by the continued popularity of trainers, as consumers’ interest in health and wellness remains strong post-pandemic. Plus, trainers continue to be regarded as superior value for money.

In contrast, clothing will see its overall share fall by 0.4ppts to 72.1% between 2023 and 2028, as consumers invest in capsule wardrobes and become less receptive to the latest trends. Clothing spend also continues to be diverted into the secondhand market.

UK apparel market drivers

- Engagement in ultra-fast fashion: The success of ultra-fast fashion players such as Shein and Cider has been supercharged by the emergence of ever-evolving fashion trends on Instagram and TikTok, influencing Gen Z shoppers in the UK to continually buy into the newest styles. Despite rising awareness of the effects of overconsumption, Gen Zs continue to prioritise price and trends over sustainability and ethics.

- Brands’ investments in new technology: With the UK online market anticipated to outperform again from 2025 onwards, brands will continue to invest in the latest technology to enhance their digital propositions. For instance, players like UK department store John Lewis, Swedish fashion brand H&M and Inditex’s Bershka brand are introducing virtual try-on features to alleviate online returns rates and make it easier for shoppers to choose the correct size. Meanwhile, UK fashion brand Primark, has been enhancing its omnichannel proposition, announcing the rollout of its click & collect service across all stores in the UK in April 2024.

- Outperformance of premium brands: The UK premium market is expected to be the best-performing price segment in the coming years, with its share rising by 1.4ppts to 21.7% between 2023 and 2028. The market will continue to benefit from shifting consumer purchasing habits, with many prioritising versatile, high-quality pieces over trend-led items as the economic outlook remains weak and budgets stay squeezed. Other players are therefore homing in on this preference, with UK department store Marks & Spencer launching several capsule wardrobe edits, while value brands PrettyLittleThing and George have introduced premium collections.

Clothing brands that have traditionally targeted adults, such as Phase Eight are now capitalising on the growth opportunity presented by childrenswear with a report suggesting the segment will be worth $225.6bn by 2028.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData