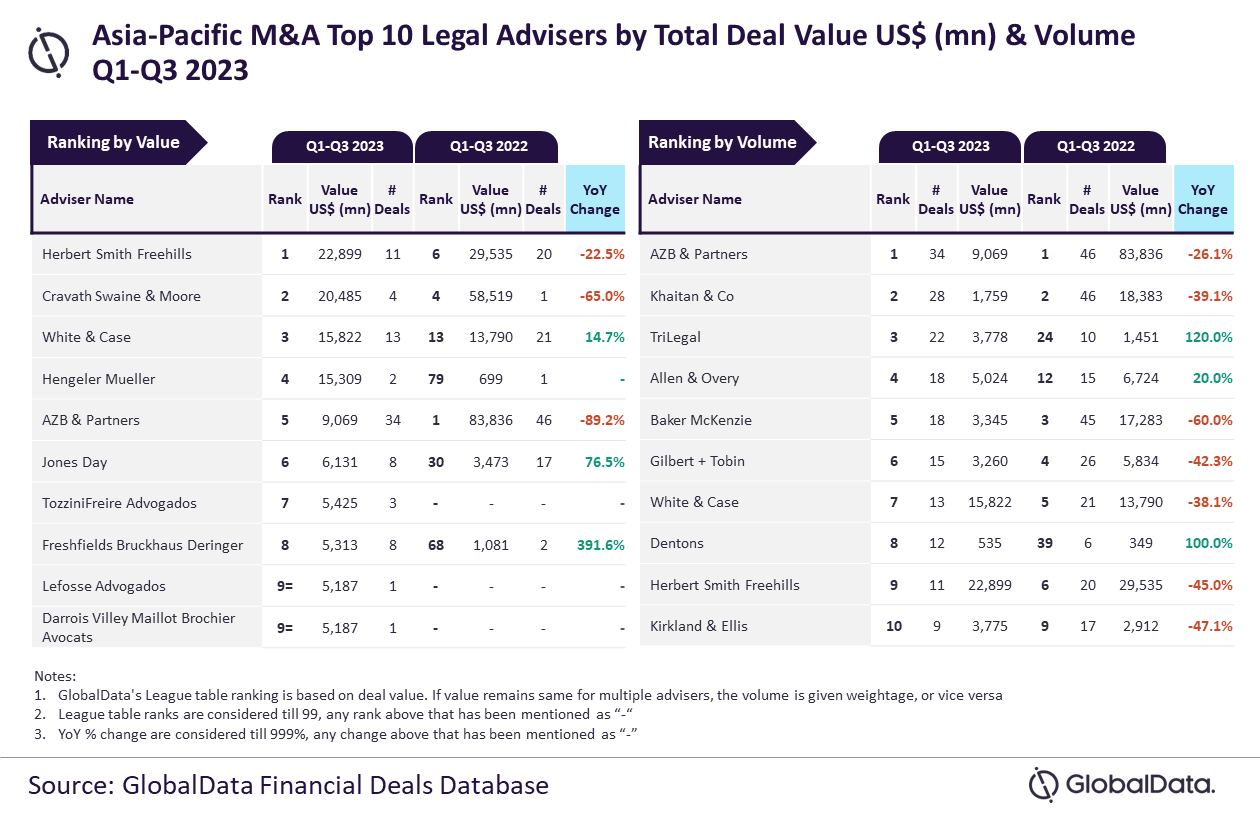

Herbert Smith Freehills and AZB & Partners were the top M&A legal advisers in the APAC region in Q1-Q3 2023, according to GlobalData’s ranking of leading M&A advisers.

Herbert Smith Freehills topped the charts when measuring the value of deals, advising on $22.9bn worth of deals during the period, while AZB & Partners advised on the most transactions with a total of 34 deals.

“Herbert Smith Freehills was among the only two advisers to surpass $20bn in total deal value during Q1-Q3 2023,” said GlobalData lead analyst Aurojyoti Bose. “Involvement in three billion-dollar deals [valued at or above $1bn] that also included one mega deal valued more than $10bn helped Herbert Smith Freehills occupy the top spot by value. It also occupied the ninth position by volume.

“Meanwhile, AZB & Partners was the only firm that managed to advise on more than 30 deals during Q1-Q3 2023. Apart from leading by volume, it also occupied the fifth position by value.”

An analysis of GlobalData’s Financial Deals Database reveals that Cravath Swaine & Moore came second in terms of value, by advising on $20.5bn worth of deals, followed by White & Case with $15.8bn, Hengeler Mueller with $15.3bn, and AZB & Partners with $9.1bn.

Measured by number of transactions, Khaitan & Co occupied the second position with 28 deals, followed by TriLegal with 22 deals, and Allen & Overy and Baker McKenzie with 18 deals each.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions of deals from leading advisers.