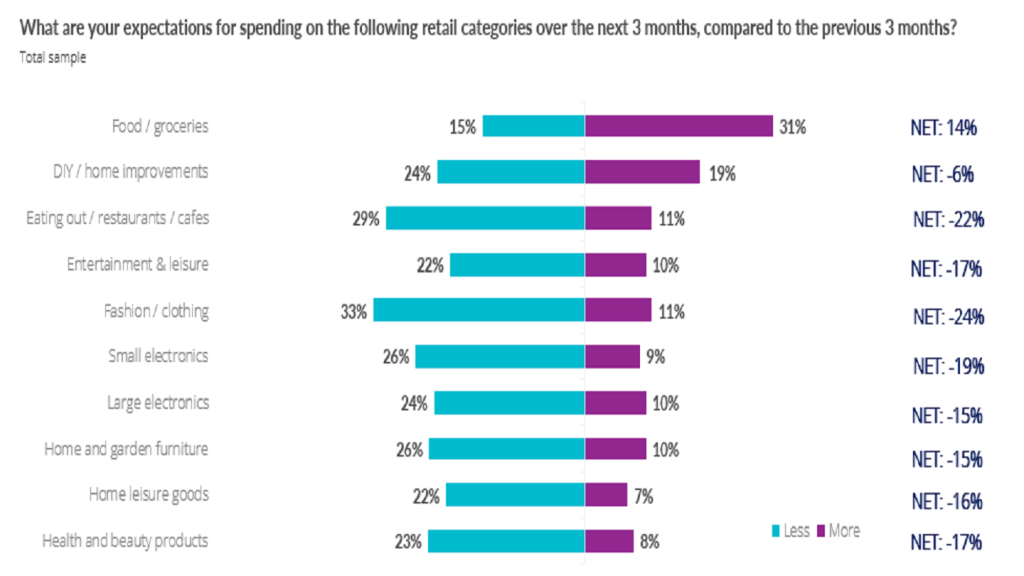

Insights from the British Retail Consortium (BRC) and Opinium data indicate a marked decline in consumer sentiment regarding personal retail expenditure over the next three months, with the index plummeting to -9 in January from -3 in December.

This contraction underscores a broader restraint, as general personal spending anticipation also receded to +4, a reduction from the preceding month’s +11.

Fashion and clothing spending projections further contracted, descending to -24 in January from -21 in December.

Similarly, prospects for personal financial situations over the same period dipped marginally to -4, from -3 in the previous month.

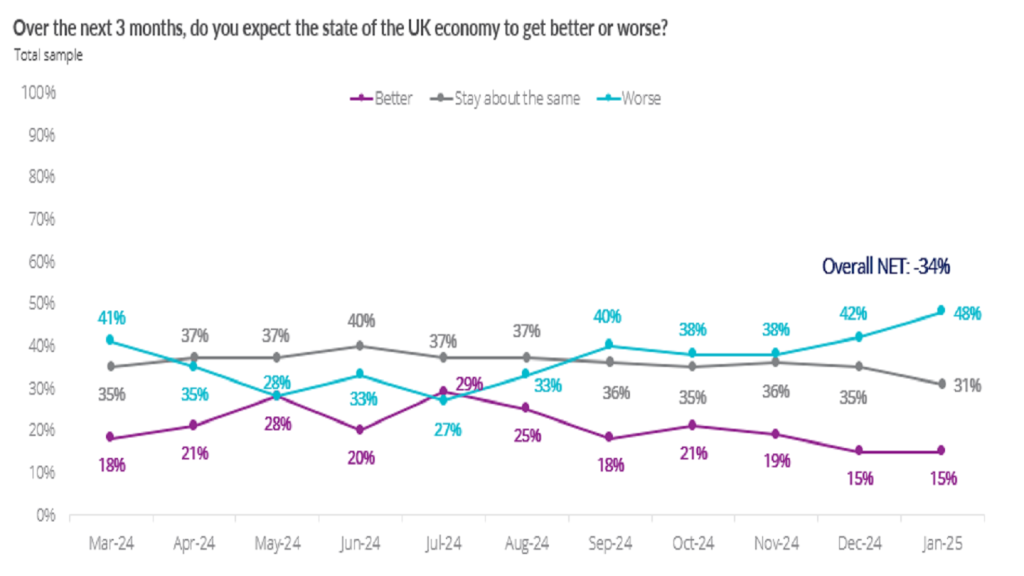

The generational divide in economic outlook was evident, with Generation Z, the cohort between 18 to 27 years remaining optimistic about improvement, whereas two-thirds of individuals aged 60 to 78 years anticipated further decline.

Despite these gloomy figures, there was a marginal uptick in personal savings expectations, which improved slightly to -3 in January from -5 in December.

BRC chief executive Helen Dickinson said: “As the government warns of tough times ahead, it is little surprise that the public have caught the January blues.

“Feelings around people’s own finances fell slightly, with older generations remaining the most pessimistic. Expectations of retail spending and wider spending both fell significantly, though much of this is likely to be the end of the Christmas period, as people tightened their belts for the new year ahead.”

“On top of this challenging market backdrop, retailers are facing £7bn ($8.62bn) in additional costs from the Budget and new packaging levy. With retailers’ tight margins leaving little scope to absorb more costs, many are warning of price rises and job cuts in the coming months. To mitigate this, and shore up investment in shops and entry level jobs, the Government must ensure that no shop ends up paying a higher business rates bill because of its proposed reforms.”

The survey’s methodology involved Opinium polling 2,000 UK adults for the BRC and the results were weighted and refined into a net score to reflect overarching trends.

A recent BRC survey, which included 52 CFOs from the UK retail sector revealed that 67% of respondents intend to raise prices in response to the higher National Insurance costs starting in April.