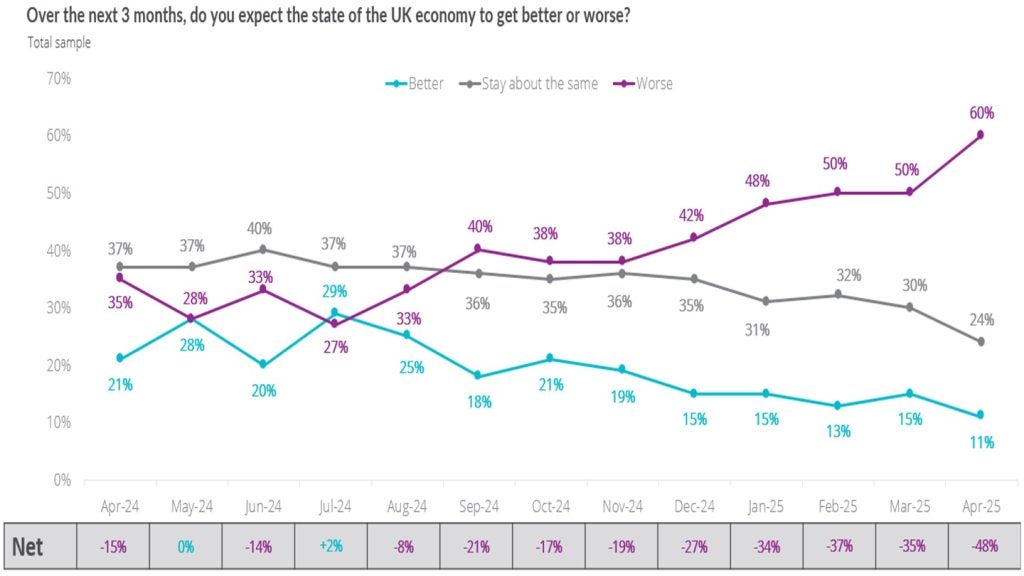

The decline in UK consumer confidence aligns with the timing of the survey, which was conducted after US President Donald Trump announced his “Liberation Day” tariffs.

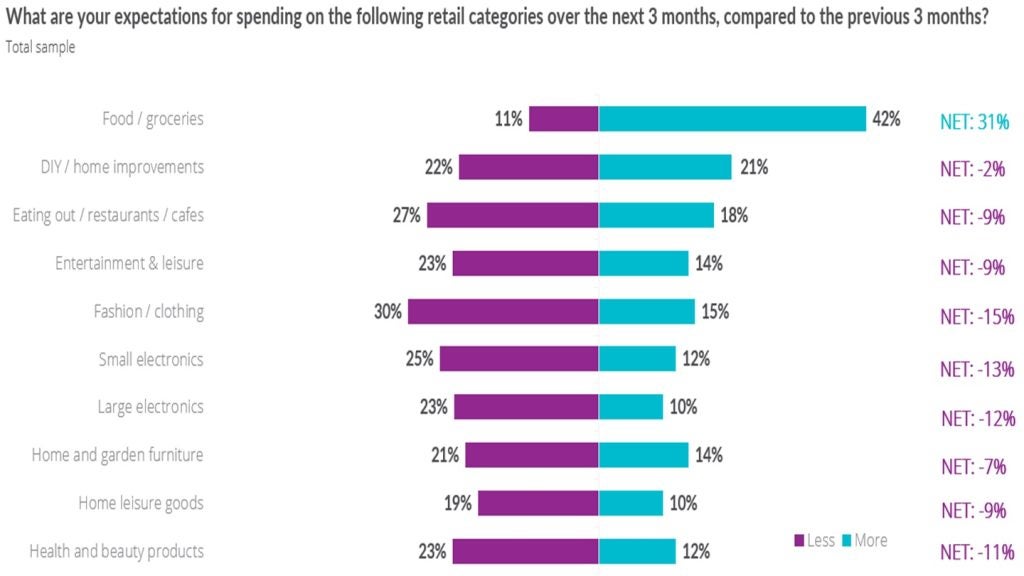

The BRC-Opinium consumer sentiment monitor revealed a slight uptick on retail spending, with the index moving into positive at +3 in April, an increase from 0 in March.

However, overall personal expenditure experienced a marginal decrease, settling at +10 for April compared to +11 in March.

Fashion and clothing spending projections stood at -15 in April from -16 in March.

British Retail Consortium chief executive Helen Dickinson explained: “The original tariff schedule, since reduced for most countries, was expected to reduce growth in the UK and elsewhere. Yet despite this economic pessimism, expectations of retail spending rose slightly as the prospect of Easter shopping drew closer.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataData indicates that anticipated expenditure on groceries has seen the most significant rise, with more than 40% of consumers predicting an increase in their spending in this category over the next few months. This sentiment is even more pronounced among individuals aged 55 years and above, where half expect to spend more on groceries.

On the other hand, Generation Z, the cohort between 18 to 27 years old, appears poised to leverage better weather conditions, showing an inclination towards higher spending on dining out and health and beauty items.

In terms of personal finances, individuals are feeling more strained, as reflected by the decline in confidence to -16 in April from the previous month’s -10.

There was a small improvement observed in personal savings sentiment, which has edged up to -4 in April from -5 in March.

Dickinson added: “Even with a pause on many of the US tariffs, business and consumer confidence remains fragile. The risk of higher global prices is an unwanted addition to the £7bn ($9.32bn) in new costs hitting retailers this year from higher employer National Insurance, increased NLW, and a new packaging tax. Many retailers are also concerned about the risk of cheap Chinese products being diverted from the US to other destinations, including the UK. The UK should review the de minimis rules, which allow low-value imports to avoid checks and duties. It is vital the UK’s strict quality standards are upheld to ensure the best outcome for British businesses and consumers.”

The survey was carried out by Opinium on behalf of the BRC, involving a sample of 2,000 adults from the UK. The methodology involves a weighting process and is presented as a net score to reflect the overall sentiment more accurately.