Any potential buyer of Footasylum has a tough job on their hands, an industry expert has said, after reports emerged yesterday (20 July) that owner JD Sports is in exclusive talks with Aurelia Group to purchase the footwear chain.

According to a report by Sky News, JD Sports has entered into the negotiations despite growing difficulties in obtaining financing for corporate deals, and amid a costly battle with Britain’s competition watchdog the CMA over its acquisition.

A source close to one of the losing bidders for Footasylum told Sky News the nature of the order from the Competition and Markets Authority meant that JD Sports’ status as a forced seller would inevitably reduce the price it hoped to obtain for the chain.

JD Sports and Aurelia Group had not responded to Just Style’s request for comment prior to publication.

In February, JD Sports was fined GBP4.3m by the Competition and Markets Authority (CMA) for allegedly exchanging information with Footasylum, which it had agreed to buy at the time for GBP90m (US$1.07bn).

The CMA had blocked the deal several times but said that following an interim order during its investigation of the deal, merger rules were breached. It claimed Cowgill and Barry Bowen – the CEO of Footasylum – exchanged commercially sensitive information and failed to promptly alert the CMA.

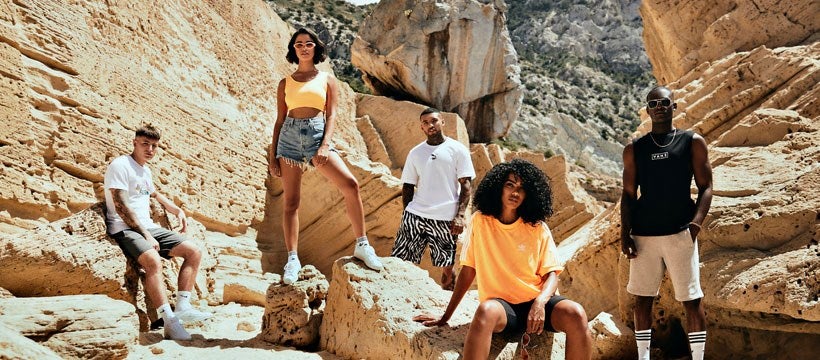

Darcey Jupp, analyst for GlobalData, tells Just Style exclusively: “Any potential buyer of Footasylum has a tough job on their hands, as the footwear specialist struggled during the pandemic despite the athleisure boom, which was especially prominent among its young target audience.

“Footasylum requires a brand refresh, and an existing sportswear specialist would be best-placed for this job. Its successful YouTube channel has been essential for the retailer to engage with young consumers, but now it must ensure that this engagement is turning into sales, particularly as inflation spirals in the UK and is disproportionally affecting its core shopper base.”

Furthermore, Jupp says that maintaining its wholesale contracts with Nike and Adidas will be vital for Footasylum’s future success due to their dominance in the footwear market, but adds “introducing smaller brands could be an interesting way for the retailer to stand out in the highly competitive UK trainer scene.”