The findings, outlined by Dr Sheng Lu, associate professor in the Department of Fashion and Apparel Studies at the University Delaware, help fashion brands, retailers, and suppliers navigate the shifting business environment and capture the critical emerging US apparel import trends.

First, as the US economy faces headwinds, US apparel imports have slowed substantially. Specifically, with US consumers struggling with four-decade-high inflation and having to prioritise budget for other necessities, the value of US clothing retail sales had zero growth in October 2022 from a month ago (seasonally adjusted). Meanwhile, US apparel retailers’ stock-to-sales ratio, a critical indicator of their inventory level, rose from 2.02 at the beginning of the year to 2.19 in October 2022 (seasonally adjusted). As a result, fashion companies were tight on cash flows to invest in new merchandise, and many chose to cut sourcing orders to control the inventory level.

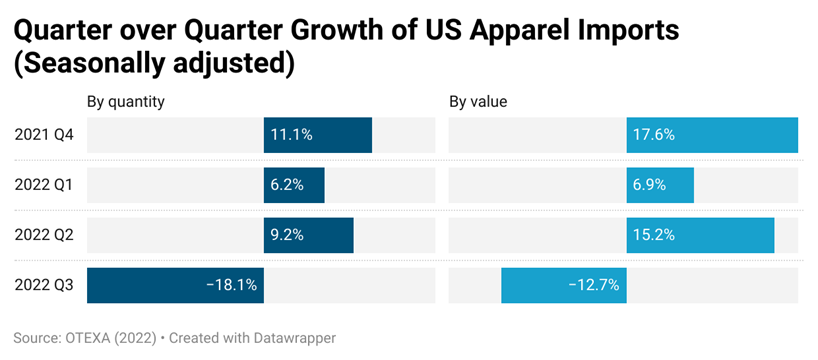

The latest trade data reflected the negative impact of the slowed US economy and consumers’ weakened demand. For example, US apparel imports in October 2022 sharply shrank by 9.3% in quantity and 4.9% in value from September (seasonally adjusted). Cumulatively, US apparel in 2022Q3 suffered a negative growth of 18.1% in quantity and 12.7% in value, the worse performance since 2021 (seasonally adjusted). Additionally, statistical analysis of the trade pattern over the past five years suggested that US apparel imports could total between $101.6bn and $109.8bn in 2022, with an annual growth rate ranging from 24.5% to 34.6%.

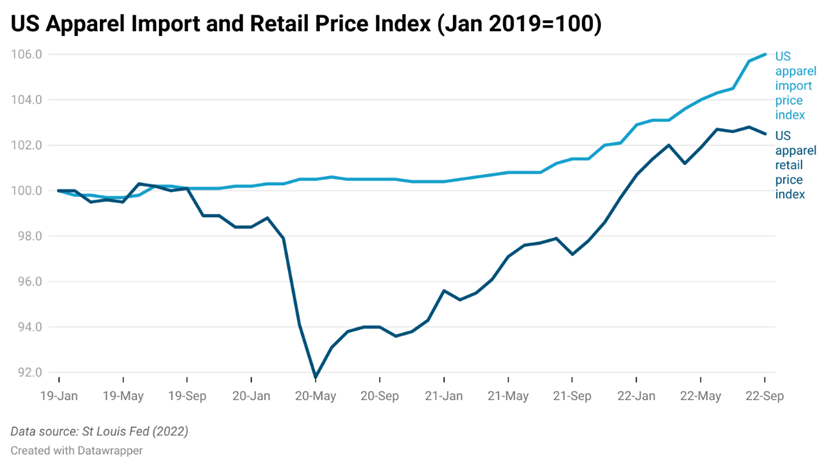

Second, the rising sourcing costs remained a significant business challenge to US fashion companies. Affected by the macroeconomic environment, the price index of US apparel imports reached 106.0 in September 2022 (January 2019=100), a 4.5% increase from a year ago and the highest since 2019. USITC data further showed that, of the over 230 categories of apparel items (HS Chapters 61 and 62, 6-digit) at the six-digit code level, nearly 68% had a price increase in the three quarters of 2022 from a year ago, including 45% experiencing a price increase higher than 10%.

On the other hand, however, due to weakened demand, US fashion brands and retailers could not entirely pass the rising sourcing cost on to consumers. For example, the US retail price index for clothing stood at 102.5 in September 2022 (January 2019=100), down from 102.8 a month ago, and was the lowest since June 2022. Likewise, industry sources indicated that from August to October 2022, US retailers offered a discount on about 60% of apparel items for sale in the retail market, higher than 48% over the same period in 2021. In other words, in the current business environment, many US fashion companies had to promote sales more forcefully, even at the cost of their profit margins.

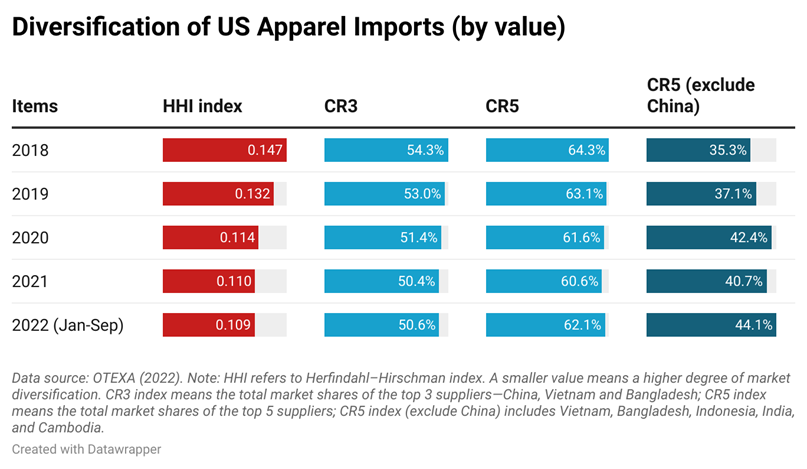

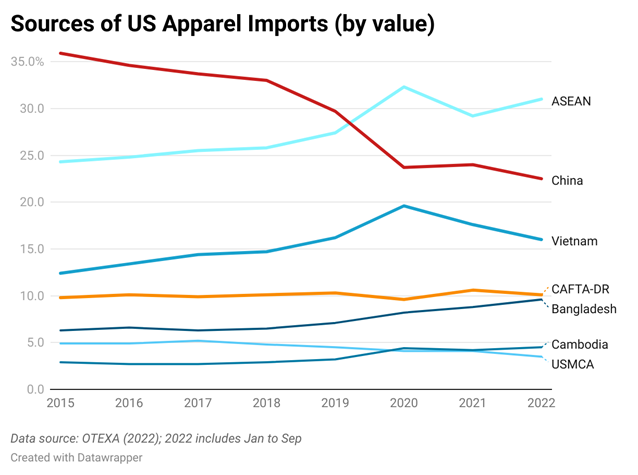

Third, US fashion companies leverage sourcing diversification and sourcing from countries with large-scale production capacity in response to the turbulent business environment. On the one hand, the Herfindahl–Hirschman index (HHI), a commonly-used measurement of market concentration, went down from 0.110 in 2021 to 0.109 in the first three quarters of 2022, suggesting that US apparel imports came from even more diverse sources, so far in 2022. However, on the other hand, the CR5 index, measuring the total market shares of the top five suppliers (i.e., China, Vietnam, Bangladesh, Indonesia, and India), went up from 60.6% in 2021 to 62.1% in the first three quarters of 2022. Notably, the CR5 index without China (i.e., the total market shares of Vietnam, Bangladesh, Indonesia, India, and Cambodia) also increased from 40.7% to 44.1%.

China was a critical factor behind US fashion companies’ shifting sourcing patterns. In particular, due to the rising US-China trade tensions and concerns about other supply chain risks associated with sourcing from the country, US fashion companies continued to reduce “China exposure.” USITC data showed that of the total 217 categories of apparel items (HS Chapters 61 and 62, 6-digit), China suffered a decline in its market shares for as many as 165 categories (or 76%) between 2019 and 2022 (January to September). Moreover, China lost more than five percentage points of its market shares for 107 categories of products (or nearly 50%).

Additionally, as US fashion companies need to balance various sourcing factors plus the textile raw material access problem, Asian countries with relatively large-scale production capacity, such as Vietnam, Bangladesh, and Cambodia, were among the most popular alternatives to “Made in China.” Many garment factories there were also invested by Chinese companies, particularly in those countries that joined China’s “Belt and Road” initiative.

Fourth, “near-shoring” from the Western Hemisphere was still stagnant. Despite the reported enthusiasm among US fashion companies for expanding near sourcing from the Western Hemisphere, the trade volume still had no significant improvement. For example, in the first three quarters of 2022, members of the Dominican Republic-Central America Free Trade Agreement (CAFTA-DR) accounted for 8.8% of US apparel imports in quantity and 10.1% in value, lower than a year ago (i.e., 9.9% in quantity and 11.1% in value in 2021). Likewise, Mexico also reported lower market shares in the US apparel import market in 2022.

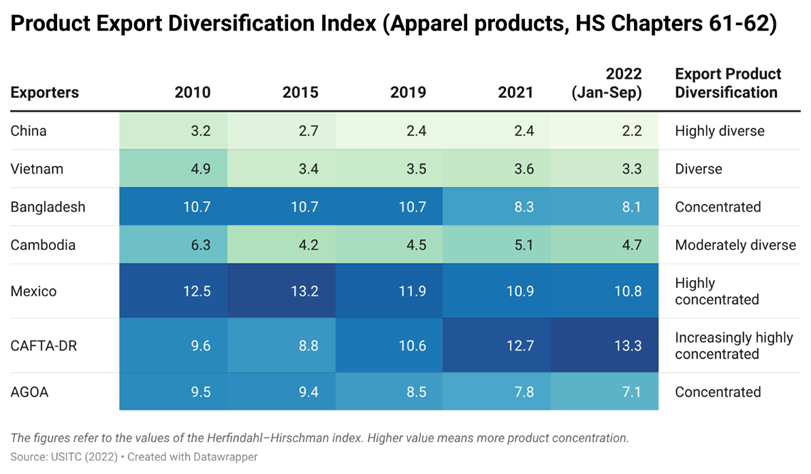

As several studies have pointed out, product diversification is a critical bottleneck that prevents more US apparel from sourcing from the Western Hemisphere. For example, the product diversification index showed that US apparel imports from CAFTA-DR members increasingly focused on a limited few categories over the past decade. In contrast, top Asian suppliers, such as China, Vietnam, Bangladesh, and Cambodia, were able to diversify their product offers consistently. As US fashion companies increasingly emphasise flexibility and agility in their sourcing decisions, offering a wide range of products will be an ever more critical competitive edge when competing for souring orders.

In August, Bangladesh recorded the largest increase in apparel imports to the US in August, while Nicaragua maintained its place in the top ten.