Tensions between the east and west, an increased focus on supply chains, and movement out of China are all factors that are having an impact on shaping M&A deals, a recent GlobalData webinar – ‘Understand the key themes driving M&A activity’ – discussed.

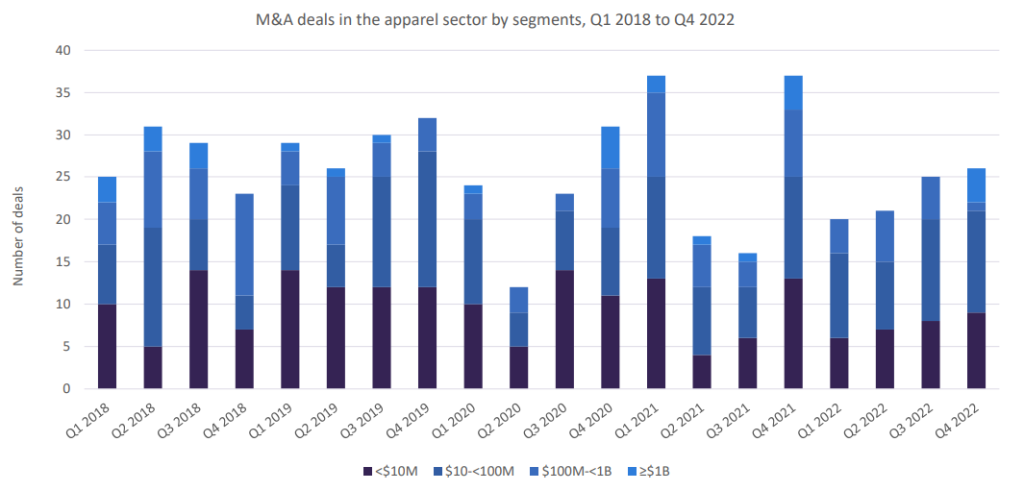

“Most sectors saw a fall in M&A activity in 2022 after the Covid-induced surge of deal making activity in 2021,” said David George, services director for Thematic Intelligence at GlobalData. “The apparel sector was no exception to this trend, with total deal value falling by 14% YoY in 2022 to total $37bn.

“Ecommerce was a major beneficiary of the Covid-19 pandemic, and though ecommerce volumes have fallen, it remains a key theme in the apparel sector. This is reflected in a number of M&A deals over the course of 2022 in this theme, most notably Estee Lauder’s acquisition of the Tom Ford brand.”

The apparel sector saw four M&A deals greater than US$1bn in 2022, compared to eight in 2021, according to the Thematic Intelligence report on ‘Global M&A Deals in 2022’ published by GlobalData, parent company of Just Style.

Overview of M&A deal activity in apparel

- M&A deal volumes dropped 8% in 2022 from $324bn to $298bn, globally.

- North America led the M&A deal activity in the apparel sector in 2022, with 88 deals worth $30bn.

- Clothing recorded the highest deal activity of all apparel subsectors, at 186 deals worth $10bn in 2022.

- The acquisition of Tom Ford International by Estee Lauder was the highest valued deal in the apparel sector at $2.8bn.

Key drivers of M&A

George noted the impact of the Ukraine conflict on Europe in particular, especially the global energy market.

He continued: “The uncertainties of the war itself will continue although the energy prices in Europe have come down, which is a positive, but that remains volatile. Then there is a broader piece of tension between east and west leading to new alliances being formed – which will also make up the backdrop for the global market.”

These factors have led to a paradigm shift in the global supply chain and trade, inevitably affecting M&A. Another prominent theme shaping deals is an increase in re-shoring/nearshoring activity; for instance supply chains being driven away from China.

The four D’s impacting apparel sector M&A

The webinar outlined the four D’s shaping the financial market in the next decade, which are having a huge impact on M&A:

- Deglobalisation – World order of the globalised supply chain is splintering and the new order of deglobalisation is the reality that reflects instability and conflict. It is important to note that re-engineering supply chains is enormous and will involve in the short term significant cost to corporates and the global economy.

- Decarbonisation – It is both a reaction to the global insurgencies as well as the climate goals themselves which will influence shaping traditional industries, like apparel. This will further lead to the alteration of industry evaluation models leading to a direct impact on the industry and company strategies.

- Demographic – Developed markets will become aware of skills shortages and an ageing population, which is a prominent fact in East Asia. It is not just Japan but also China where the population decline is evident. As George put it: “China will face a similar curve of ageing population as we see in Europe and the US.”

- Debt – High interest rates are proving to be challenging, particularly for some emerging markets, and for some corporates. China has high debt levels and issues around the property market, which will be a structural drag.

A subdued 2023

Looking ahead to the remainder of 2023, while deal transactions fell globally, GlobalData estimates the M&A market, across all industries, is expected to remain subdued, with double digit declines in deal value for 2023 followed by macro weakness, rising rates, equity market declines and elevated uncertainty.

According to GlobalData, January was registered as a weak month with deals down over 50% YoY.

What else can we expect:

- Declines are still expected overall, certainly in the first half.

- Interest rates hopefully will stabilise – probably not imminently but towards the end of the rate rise cycle at the middle of this year.

- No big cuts to interest rates but there may be more liquidity and more funding.

- ESG will remain a huge focus area with companies trying to measure and track the parameters – for instance, disclosing scope 3 emissions across the value chain.

- Sovereignty will be a real issue – particularly greater scrutiny around technology and data privacy.

- Cross-border deals are a large component of M&A but with increasing restrictions and new rules around Foreign Direct Investment (FDI) it is becoming difficult.