Tackle the Apparel Supply Chain’s Biggest Problems

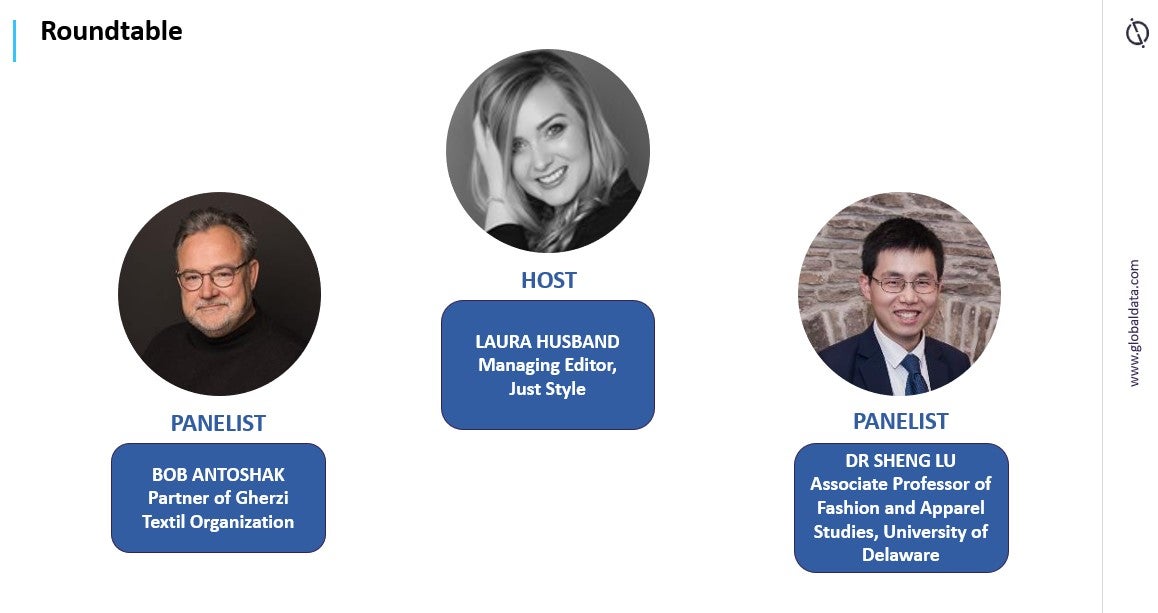

The live discussion, which took place during GlobalData’s Apparel Conference yesterday (11 October) aimed to shed some light on the world events that are having the biggest impact on the industry right now as well as provide some quick-win solutions to the biggest problems for brands, retailers and sourcing executives.

The biggest problems facing the apparel supply chain and wider sector right now

1. Inflation and rising energy costs

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

University of Delaware’s associate professor of apparel and fashion studies, Dr Sheng Lu, told the audience the latest Office of Textiles and Apparel (OTEXA) data, which was published earlier this month, shows the volume of US apparel imports has dropped.

He explained: “There is a lot of uncertainty in the US economy such as how to deal with inflation which impacts consumers’ consumption of clothing. And, even though we’re seeing shipping costs go down, companies still face rising sourcing costs so it’s a really challenging time.”

He argued, however, that now is a great time for apparel brands and retailers to test friendships and partnerships with vendors.

He said: “Like it or not, fashion brands and retailers still have a lot of leverage over vendors and can do a lot to support them during these difficult times. For example, it’s about how you deal with your existing sourcing orders and when you’re willing to make the payment and the price you’re willing to pay. I still think there are many areas where brands and retailers can engage in dialogue with vendors and show support.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataHe was quick to add that one key lesson the industry learned from the pandemic is the relationship between vendors and importers is critical to the success of the whole industry.

2. Russia-Ukraine War

Gherzi Textil Organization’s partner Bob Antoshak said the impact of the Russia-Ukraine war on the apparel sector is based on both hard economics and psychology.

He explained: “The psychology is terrible right now and it’s weighing on all of the markets. The price of cotton for example, has been down sharply. It makes no sense when you’ve got cotton gins in Texas suffering from a drought and 60% of Pakistan’s cotton has been wiped out by a flood. Normally cotton prices should be moving rapidly in the other direction but it’s just not. The question is why? Psychology is bad and demand is bad.”

Antoshak said the inventory accumulation that’s occurring downstream has rippled all through the supply chain and it’s created imbalances between supply and demand.

He added: “Coupled with that are the unknowns of the war. Our industry might not be involved in those markets other than in a limited way but it’s had a ripple effect that’s carried over into so many other areas. The unknowns of the conflict will weigh heavily on the entire apparel supply chain going all the way back to the farm. It will lead to imbalances throughout the supply chain and this last quarter is going to be really difficult.”

Antoshak was adamant however that apparel brands cannot and should not repeat what happened at the start of the pandemic where backs were turned on certain suppliers.

He stated: “It didn’t work out well last time and the industry has learned it is stronger together than by cutting and running.”

3. Pakistan floods

Antoshak highlighted the recent Pakistan floods have affected the textile and cut and sew sectors directly with a lot of factories being hit.

Additionally, he said the remaining portions of Pakistan’s apparel and textile industry that were not affected are now struggling with the shortage in domestic cotton.

“The US has been a large importer of Pakistan cotton in recent years but what happens when Pakistan is forced to import cotton from say the US? It also comes at a time when a lot of Texas cotton crop was lost due to a drought. Normally, you’d think that would pull prices up, which would increase the operations for the Pakistan mills. Plus a lot of cotton sales are priced in dollars so when you combine all of these factors it is a really challenging time for Pakistan’s apparel industry.”

4. Sustainability

Lu pointed out that there is some concern that brands and retailers will overlook the ongoing climate change issue such as the impact of the floods in Pakistan in favour of more pressing topics.

Fortunately, he said his observations and research show this is not the case: “I recently did a study in collaboration with the US Fashion Industry Association (USFIA). We spoke to some of the largest US fashion companies who said they plan to dedicate more resources to the issue of sustainability. This includes investing in education for staff and vendors to develop a more sustainable and socially responsible sourcing model.”

He believes companies are changing their mindset around the issue: “In the past it was viewed as a burden but these days more companies see sustainability as an investment that will provide a financial return in future.”

For example, he continued: “One current project I’m working on is to understand companies’ sourcing strategy for clothing made from recycled materials.”

He explained sourcing these products can help fashion companies achieve their goals such as how to reduce their reliance on China, how to diversify the sourcing base and how to expand nearshoring and onshoring and improve speed to market.

He added: “In fact, sustainability itself and the act of being sustainable provides the fashion industry with lots of potential for future business opportunities.”

5. Supply chain disruptions and forced labour controversies

There are two big trends when it comes to tackling supply chain issues, said Lu. Sourcing diversification continues to be the main theme because sourcing executives today have to consider a lot of factors such as cost, speed to market, flexibility, agility and all kinds of compliance risk.

Lu is confident that having a relatively diverse sourcing base will mitigate all kinds of risk and said: “Like it or not there’s no perfect suppliers out there and all countries have their own advantages and disadvantages. This is why brands today need to source from a diverse group of countries to balance all of these factors. Some products might have speed-to-market as the priority so that will be sourced closer to home, for example.”

Strengthening the relationship with key vendors is also incredibly important and Lu made the point this second trend is not contradictory to the first.

“These days brands and retailers like to work with so-called super vendors that might have a multiple-country presence or be able to do vertical manufacturing, which can help fashion companies to achieve their goals in the short to medium-term,” he said.

What are the solutions to the apparel industry’s biggest challenges?

Anotshak believes the solution to these problems facing the apparel sector is two-fold. He said: “Firstly, sourcing diversification is important. For many years brands got complacent and were sole sourcing, which worked well for them at the time.”

In fact, he told the audience quite bluntly the sourcing model has to change because the world has changed: “Supply chains are disrupted and economies have become messed up and not to mention the fact we have a war thrown in now too.”

The second part of his solution lies in partnerships. He said: “This isn’t just about buying from vendors 1, 2 and 3 or tiers 1, 2 and 3. In order to succeed these partnerships need to go deeper than that and become established.”

Antoshak concluded: “The brands and retailers who are implementing sourcing diversification and partnerships will have a much better chance of navigating this difficult river that we’re all on right now.”

Lu agreed with Antoshak’s points but was keen to add: “The companies that are willing to invest in the future will be more likely to succeed and reap the rewards. There are a lot of areas that companies can invest in right now such as sustainability and new technology and this also includes investing in our young future professionals too.”

He also kindly advised brands and retailers to read sector-specific publications such as Just Style regularly in order to benefit from the regular insights and analysis that is shared on how to navigate these challenging times.

Thankfully, Lu said he is confident about the future of the apparel industry despite these challenging times. He stated: “We can’t forget that global apparel is a US$2.5 trillion business and for all of those working within it – we need to make it succeed – and we will.”