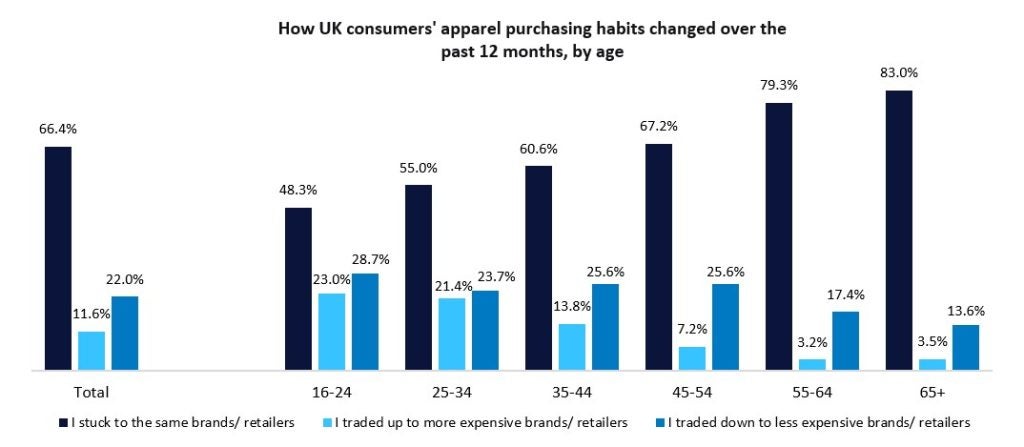

While 66.4% of UK apparel shoppers in GlobalData’s June 2024 UK consumer survey stuck with the same brands and retailers over the past year, 22.0% traded down to more affordable players.

Only 11.6% traded up to more expensive brands and retailers, however, this rose to 22.1% among under 35s.

More stability is expected in the next year, with the percentage of shoppers sticking with the same brands rising to 70.5%, and there will be slightly more consumers trading up, while less will feel the need to trade down.

Over 55s most underserved in UK apparel market

Over the past 12 months, 81.5% of UK shoppers over 55 continued to shop at the same brands and retailers for apparel, as they were typically less impacted by inflationary challenges due to being on higher incomes or in retirement.

This demographic is also the most underserved in the market though, so consumers would have had less options of brands to switch to, and overall they account for a much lower proportion of apparel spend than young consumers.

Of those that did pivot to different brands and retailers, there is much greater disparity between the age groups for those trading up, with 23.0% of 16-24s and 21.4% of 25-34s doing so, versus only 6.8% of over 35s.

This will partly be driven by younger consumers previously being much more inclined to shop for low-cost fast fashion, giving them greater scope to switch to higher priced players as they focus on value for money.

The most common reason for consumers trading down to cheaper brands in the last 12 months was to save money, as stated by 75.8%. This rose further to 87.8% among over 65s. Similarly, 35.0% of shoppers cited that it was because they had less disposable income, highlighting the impact high inflation is having on fashion budgets.

15.0% made the shift so they could prioritise spending their money elsewhere, which was also most common among older respondents, as fashion is less of a priority to them. 14.9% switched to cheaper brands to find more variety, which will have been boosted by the meteoric rise of Shein which lists thousands of new products each day, giving young shoppers more choice than ever before.

Source: Data is derived from GlobalData’s UK monthly survey of 2,000 nationally representative consumers conducted in June 2024. Respondents had purchased clothing, footwear and/or accessories in the past 12 months.

Over third of UK apparel shoppers seek quality, long lasting products

A search for better quality, longer lasting products was the driving factor for 37.6% of shoppers that purchased from more expensive brands in the last 12 months, as many became more mindful of cost per wear.

27.6% traded up because brand name is important to them, while 26.7% had more disposable income, as the job market continued to see improvements and salary rises began to outstrip inflation at the end of 2023. 25.5% traded up because they preferred the styles of more upmarket players, while 21.7% sought more elevated styles, and 21.2% were investing in wardrobe staples.

Even value and mass market players can capitalise on the latter two drivers if they play their cards right, with M&S launching a capsule collection in March 2023, featuring a curated edit of timeless pieces, and George at ASDA introducing a new premium range in September 2023, offering elevated styles at affordable prices. When asked how they expect their apparel purchasing habits to differ over the coming year, the proportion of UK shoppers planning to shop with their usual brands and retailers rose to 70.5%.

This is supported by the ongoing easing of inflation in the UK, allowing consumers to feel more confident with their finances. While 12.4% anticipate that they will be trading up, representing a slight increase from the past year bolstered by a recovery in discretionary incomes, the proportion intending to trade down is beginning to wane, at just 17.0%.

Shoppers aged 25-34 are now more like to trade up than trade down, with 25.8% and 19.3% of respondents expecting to take each of these actions in the year, respectively, as the capsule wardrobe trend continues to gain traction on social media