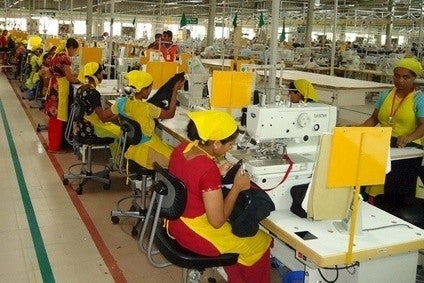

Bangladesh has been placed second on a list compiled by supply chain compliance solutions provider Qima comparing the ethical auditing practices of major manufacturing countries.

In its report ‘2020 in Review: Global Trade Covid Disruption Reveals Changes in Consumption Habits and Rampant Ethical Risks, as China Sourcing Beats the Odds’, Qima says the challenges of the pandemic have strongly exacerbated human rights risks in global supply chains. Issues range from increased vulnerability to modern slavery and child labour, to labour violations in factories and less scrutiny on non-virus-related safety measures due to health and safety resources being stretched thin.

Qima ethical audit data collected at reopened factories as well as in the course of remote audits show the percentage of factories ranked “red” for critical non-compliances increased by more than 100% in the second half of 2020 compared to the first.

Some of the most pressing issues are in the area of working hours and wage compliance: in China, 14% of factories audited were given a failing grade due to critical violations in the area of working hours and wages. Examples of violations include sanitation duties being imposed as unpaid overtime, as well as workers being pushed to work excessive hours to meet tight schedules for high-demand goods, such as personal protective equipment (PPE).

“In response to the mounting ethical risks and limited physical access to factories, more businesses are accelerating the adoption of technological solutions for compliance and quality control, which include remote audits, worker voice solutions and integrated QC and compliance platforms that enable them to map their sourcing network and achieve better visibility into multiple supply chain tiers,” Qima said in the report.

Despite this, Bangladesh appeared second on the list, behind Taiwan, with Vietnam placed third. China was seventh on the list behind Pakistan and Turkey.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataQima says China, the first to suffer from Covid-19, showed some resilience in 2020. After a disastrous first-quarter marked by a manufacturing standstill and demand shock, China sourcing throughout the rest of 2020 followed a slow yet steady trajectory towards recovery. Towards the end of the second quarter, demand for inspections and audits in China returned to 2019 levels, and from there continued to grow throughout the second half of the year, only stalling in December as lockdowns were reinstated in multiple Western geographies.

Ultimately, 2020 saw inspection and audit volumes in China contract -3% year-on-year compared to 2020 – which, despite the year of unprecedented disruption, represents a smaller drop in sourcing volumes compared to the -3.3% year-on-year drop observed in 2019 in the wake of US-China tariff war.

“At least partially responsible for this relative resilience was the renewed interest of US buyers, who were in much less of a hurry to leave China in 2020, following the gradual easing of trade tensions in the wake of the ‘phase one’ trade deal signed in January 2020,” Qima explains.

However, while China landed a better year than anticipated, the pandemic gave a powerful boost to the long-term trend of shifting buying volumes to its regional competition: demand for inspections and audits in Southeast Asia rose 19% year-on-year across the board in 2020 – twice the 2019 vs. 2018 year-on-year growth rate.

As a whole, this region recorded double-digit expansion in inspection and audit demand starting from July, buoyed by buyers looking for alternatives to China both in the short and long term, as well as by massive orders for PPE, Qima says.