Luxury conglomerate Tapestry, which owns brands including Coach, Kate Spade and Stuart Weitzman, was relying on its merger with rival luxury group Capri Holdings to fuel “a new growth story,” according to data analytics company GlobalData.

However, in April, the US Federal Trade Commission (FTC) sued to block the merger, alleging that Tapestry’s acquisition of Capri would “eliminate fierce competition between the two companies.”

With the deal in doubt, GlobalData noted that Tapestry is “more exposed” thanks to softer demand dragging down its numbers. Moreover, the weak outlook makes winning the battle with the FTC crucial.

Tapestry’s Q3 2024 results in-brief

- The group’s net sales declined from $1.51bn to $1.48bn.

- Operating income fell from $226.3m to $204.3m.

- Net income was $139.4m as opposed to last year’s $186.7m.

GlobalData believes this quarter’s soft results from Tapestry underline why the group is so keen to acquire Capri.

The company said: “After a run of reasonable performance, the business is running out of steam and its ability to punch out strong results is becoming increasingly inconsistent. Bringing on board Capri provides Tapestry with more levers it can pull to engineer better numbers. There is nothing wrong with this approach, even if the price offered for Capri is very toppy, but the intervention of the FTC into the case has thrown something of a wrench into the works.”

GlobalData views the 1.8% revenue slump as Tapestry’s “worst sales performance” in a year, indicating increased pressure on the company and that not all its brands are pulling their weight in the more challenging market environment.

However, it highlighted that while currency fluctuations have contributed to some of the decline, even after adjusting for these factors, group revenue did not grow compared to the previous year.

M&A dwindles after 2022

Companies in the apparel sector have historically relied on Mergers & Acquisitions (M&A) for driving growth, navigating inflationary environments and supply chain pressures amid muted demand for fashion.

Ed Bradley, founder and CEO of European dropshipping platform Virtualstock, told Just Style that M&A activity focused on fortifying supply chains should be a key tool in the arsenal of fashion executives going into 2024.

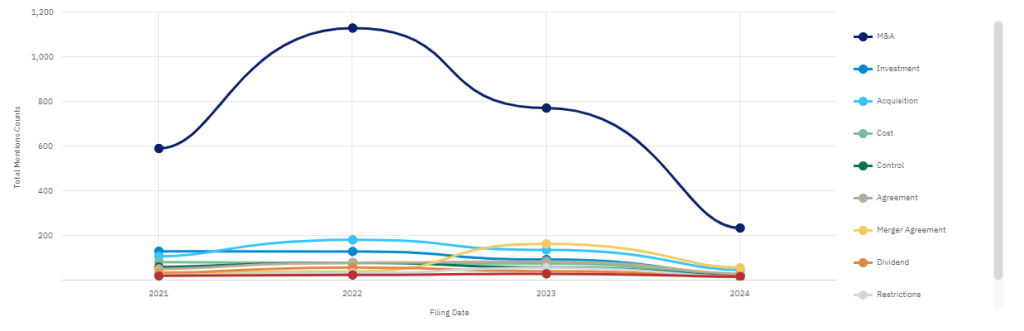

According to GlobalData’s company filings data from May 2021 to 2024, mentions of M&A peaked in 2022 with the keyword being used 1,130 times before it dwindled to just 235 mentions in 2024.

Other keywords that followed were Merger Agreement and Acquisition with 57 and 47 mentions in 2024 so far, respectively. This illustrates a broader trend of lower M&A activity in the apparel sector currently.