This week’s top apparel-related datasets ranged from Primark expanding its Click + Collect service across the UK after an impressive H1 and JD Sports growing its US footprint to Express Inc navigating its store closures.

Primark delivers strong H1 with sales up 7.5%

UK fashion retailer Primark, which is owned by Associated British Foods has reported a 7.5% surge in H1 revenue (24 weeks ended 2 March 2024) to £4.5bn ($5.56bn) compared to £4.2bn in the same period the year before.

The retailer credits its success to continued growth in selling space with newly opened stores. It also noted like-for-like sales were up 2.1% and this was driven by good performance across most markets due to pricing and well-received product ranges.

Associated British Foods chief executive George Weston admitted the consumer is yet to fully emerge from cost of living pressures, however he maintained the group is well positioned to deliver good returns to shareholders.

Primark plans to expand its Click + Collect service to all UK stores by the end of 2025 following an 18-month trial with Primark's chief executive Paul Marchant stating: "We’re now confident that we’ve found a model that can do both and support us with our plans to grow the business."

Express Inc to close 107 stores amid bankruptcy

US apparel retailer Express Inc is expected to close 95 of its Express stores and all 12 of its UpWest stores as part of its recent bankruptcy announcement.

It has received a non-binding letter of intent from a consortium led by WHP Global including a wholly owned indirect subsidiary of Simon Property Group, L. P. and Brookfield Properties for the potential sale of a substantial majority of the company’s retail stores and operations.

Express Inc's chief executive officer Stewart Glendinning noted: “We are taking an important step that will strengthen our financial position and enable Express to continue advancing our business initiatives."

He added the company continues to make meaningful progress refining its product assortments, driving demand, connecting with customers and strengthening its operations.

However, the company's bankruptcy followed a drop in sales in its third quarter and a net loss of $154.2m versus $39.3m a year earlier.

JD Sports eyes US growth with latest acquisition

UK sportswear retailer JD Sports Fashion Plc has acquired US athletic-fashion retailer Hibbett in a bid to boost the region's contribution to its total sales.

The retailer believes its latest purchase will give it a combined revenue of £4.7bn ($5.85bn) in North America and will change the region’s contribution to total sales from about a third (32%) to two fifths (40%).

The $1.08bn deal would include Hibbett's 1,169 stores in 36 states across the US with its main retail facias being Bibbett and City Gear.

GlobalData senior apparel analyst Pippa Stephens believes the expansion would provide “significant potential” to the UK retailer but added it must not “overextend” itself as German sportswear brands adidas and Puma are currently underperforming in the region “due to economic and geopolitical uncertainty".

Clothing deemed 'problem child' in Sainsbury's 2023/2024 results

GlobalData retail analyst Eleanor Simpson-Gould described Sainsbury's Tu clothing range as its "problem child" after the UK supermarket reported a 6.4% drop in its annual clothing sales for 2023/2024 (52 weeks ended 2 March 2024).

Grocery on the other hand delivered a standout performance with a 9.4% increase in sales and its overall group sales were up 3.4%.

Simpson-Gould pointed out that while Sainsbury’s outperformed the food and grocery market in 2023 (+8.3%), it continues to struggle in its general merchandise and clothing categories with both sectors failing to provide positive growth past the first quarter.

She added: “The grocer’s Food First strategy, launched in November 2020, has correctly been replaced with the Next Level Sainsbury’s strategy update, which encapsulates a wider focus on retaining momentum in grocery sales and addressing the problem child of its non-food proposition, but will require adept and rapid roll out to provide positive sales momentum to counter declines in food and grocery sales expected in Sainsbury’s first half.”

Hanesbrands on track with sustainability targets

US apparel conglomerate Hanesbrands has reported it is making strides toward reaching its 2025 and 2030 sustainability goals, including achieving zero waste across its operations by 2025 and using 100% renewable electricity by 2030.

The company's CEO Stephen Bratspies said he believes that meeting consumers' expectations is how Hanesbrands makes sustainability accessible for all.

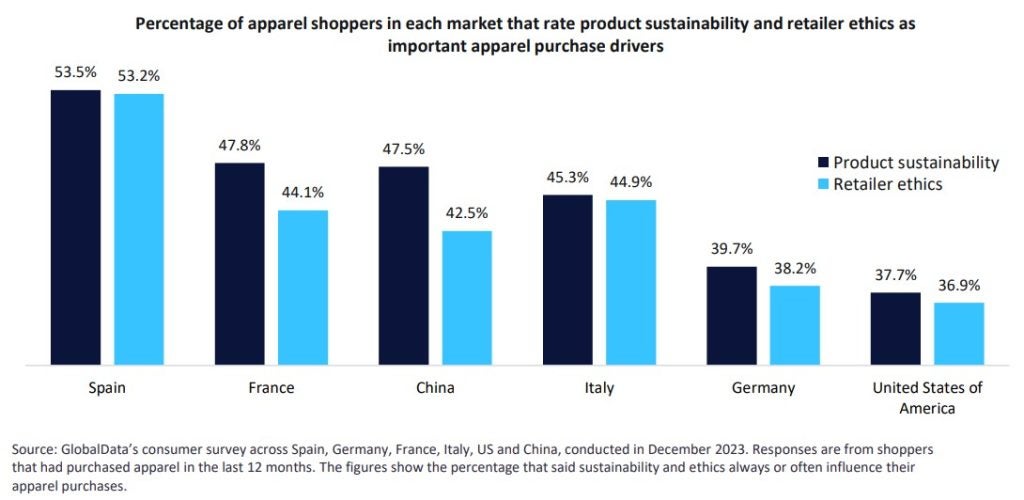

However, a recent consumer survey conducted by GlobalData suggested apparel shoppers are currently prioritising price, quality and value for money above sustainability and ethics due to the ongoing economic crisis.

The survey revealed Spanish consumers are most concerned about product sustainability and retailer ethics with over half of those surveyed taking an interest in both. However, in the US only 37.7% of those surveyed saw product sustainability as an important apparel purchase driver and only 36.9% of US shoppers saw retailer ethics as an important apparel purchase driver.