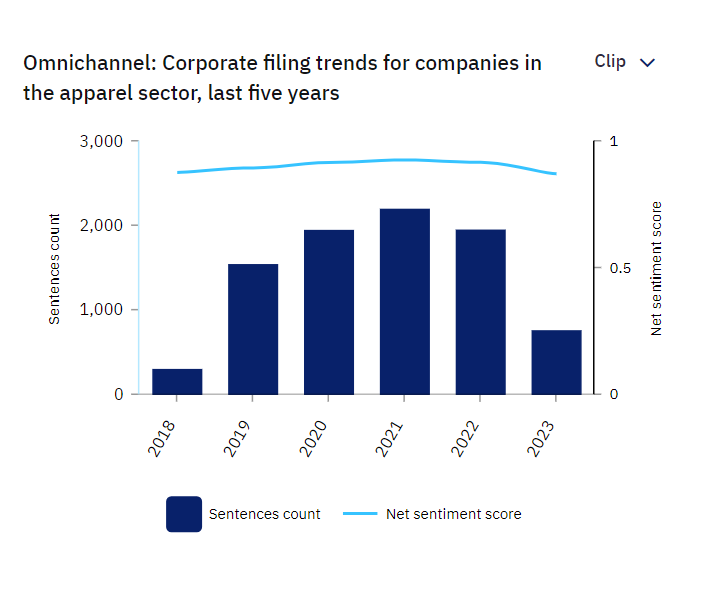

New figures from GlobalData show that the number of mentions of ‘omnichannel’ in apparel company filings has fallen in 2023, after peaking in 2021.

Mentions of ‘omnichannel’ in apparel company filings since 2018

Source: GlobalData

In 2023 so far there have been 758 mentions of ‘omnichannel’ in apparel company filings, down from 1,948 in 2022 and 2,195 in 2021, when mentions of the commerce trend peaked.

This means that 2023 is currently on track to have the lowest number of mentions of ‘omnichannel’ in apparel company filings since 2018, when the topic was mentioned just 379 times.

The apparel companies mentioning ‘omnichannel’ most often in their filings include Dutch retail group Koninklijke Ahold Delhaize, Indian department store Shopper’s Stop, US supermarket giant Walmart and UK retailer Marks and Spencer.

Since the Covid-19 pandemic and associated restrictions have lifted, some customers have returned to physical stores, although online sales still remain high. Rising inflation has also caused many consumers to reduce their clothing budgets in recent years.

Some high-street fashion retailers have also recently doubled down on physical stores, with Frasers Group signing leases for more than 180,000sqft of UK retail space in a bid to increase its brick-and-mortar offering.

However, despite these figures, a number of fashion brands have continued to focus on an omnichannel strategy in recent months.

Our signals coverage is powered by GlobalData’s Thematic Engine, which tags millions of data items across six alternative datasets — patents, jobs, deals, company filings, social media mentions and news — to themes, sectors and companies. These signals enhance our predictive capabilities, helping us to identify the most disruptive threats across each of the sectors we cover and the companies best placed to succeed.