The European Outdoor Group’s (EOG) State of Trade market research programme indicates that the outdoor sector has bounced back strongly following the height of the Covid-19 pandemic. The EOG works with members and stakeholders to collaborate on a range of projects of shared interest, such as market research, responsibility and sustainability, and currently has over a hundred members.

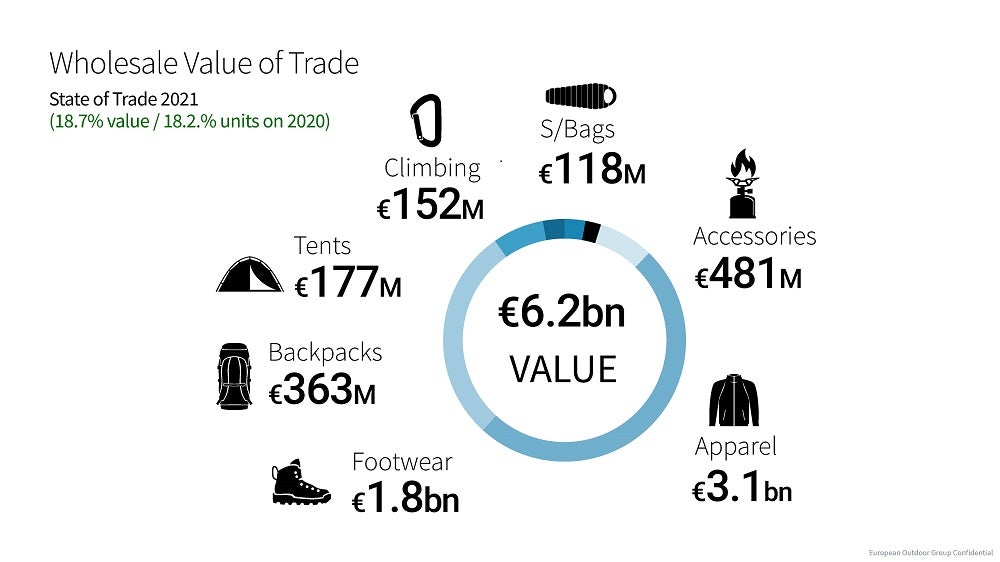

The EOG State of Trade report covers products sold by over 100 outdoor companies in Europe in the apparel, footwear and hardware markets, and includes outdoor sell-in figures from multisport/ lifestyle brands. The report includes data in seven main categories and 48 separate sub-categories.

Sell-in figures for 2021 reveal that the wholesale value of the key product categories in the industry topped EUR6bn for the first time, while the volume of units sold during the year has been calculated at 240m.

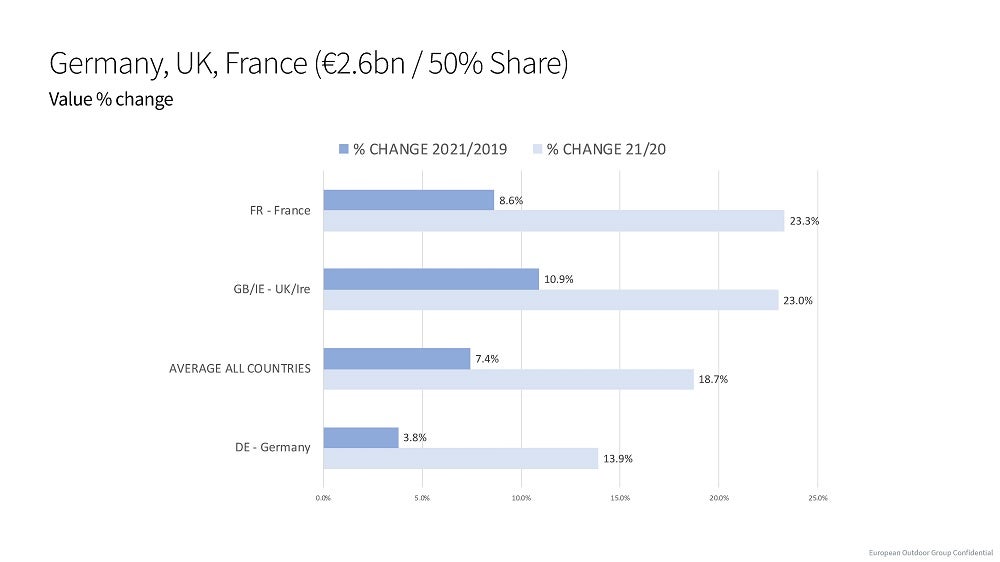

The figures show many businesses reported high double-digit growth in 2021, with an average of +18.7% in value overall for European markets when comparing 2021 to 2020, and +18.2 % in units. There was also significant growth compared to pre-pandemic 2019 of +7.5% in value and +5.3% in units.

In 2021, the total wholesale value of every product category covered by State of Trade was EUR6.2bn. This is the first time that the overall State of Trade value figure has been higher than EUR6bn. Each of the individual product categories experienced growth during the year.

Pauline Shepherd, European Outdoor Group head of market insights, said, “It is clear that the outdoor sector has excellent underlying resilience. In 2021, this allowed brands to benefit from the public’s increased appetite for getting out into nature, which was prompted by lockdowns around Europe. Our industry adapted very well to rapidly changing circumstances and overall, reaped the rewards as restrictions eased.

“Sustaining that boom in participation will be tough and along with ongoing supply chain issues and the increasing cost of living, we know that businesses face some significant challenges this year and beyond. However, the outdoor sector is fundamentally in robust shape, and can meet those challenges from a position of relative strength.”

Strongest growth was recorded in apparel and footwear, both up by 20%, representing an excellent recovery, as the two categories registered the biggest declines in 2020. Tents and outdoor accessories continued to perform well, due to sustained strong consumer demand for activities such as camping. These markets were also affected less in 2020 as some countries allowed travelling within borders, and citizens took to the holidaying at home ‘staycation’ trend.

Regionally, all countries recovered during 2021, but the UK, Austria, and southern and eastern regions all outperformed the average growth in the market. Looking at the three largest markets, which make up 50% of the total value of the European outdoor sector, there were variations in how the recovery developed for each. The UK and France outperformed the overall industry average, while Germany lagged slightly, although still registered growth.

In addition to its annual State of Trade European sell-in report, the EOG can also draw on retail development data trends from the Outdoor Retail Benchmark Report. The report is a like-for-like analysis of the aggregated sales development of the EOG retail members, and as such currently reflects the German market. The performance of retail sell-out was up 17.4% year to date to April 2022, compared to the same period last year for the outdoor segment.