The Manufacturers’ Health Index shows the the UK apparel manufacturing sector performed well in Q2 2024 compared to other manufacturing sectors.

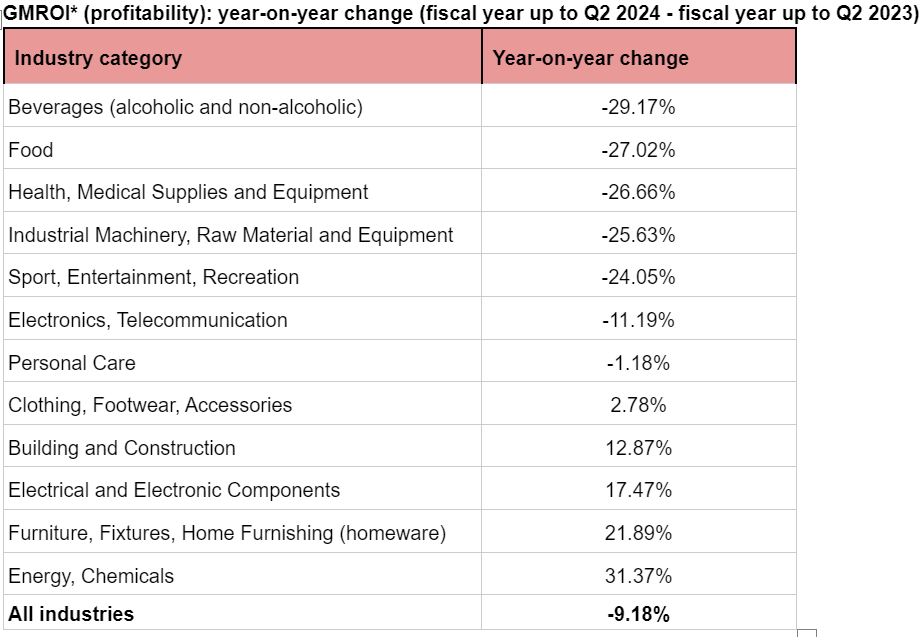

The index, which is released by inventory management software provider Unleashed every quarter, suggests clothing, footwear and accessories manufacturers’ 2.7% profitability was an exception to the rule with beverages seeing the greatest decline of almost 30% and sports down 24%.

On average, profitability across the manufacturing industry declined by 9.18%, despite sales performance rising by 9.16%. However, the index noted that some sectors are “powering through.”

Quarterly sales revenue plummet for UK manufacturers

Unleased also revealed a sharp decline in UK sales performance this quarter compared to the overall upward trend in comparison to Q1 2024 with total revenues falling by 22% in Q2 2024.

Credit: Unleashed Manufacturers’ Health Index

Clothing and footwear was the only manufacturing sector to see an increase in revenue of 5% in Q2 2024.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe struggle to beat inflation, passing costs on to customers

According to James Bennett, a fractional CFO for several product businesses, the inflationary effect of raw materials is not to be underestimated and there’s been a reluctance to see that full inflation cost passed on to consumers.

Bennett stated: “My clients are worried about losing business and the associated revenue. The question commonly being debated is: How much can you put the price up by? If your product is targeted at the higher end of the market, are your consumers more or less affected by the cost of living? The cycling shoe brand is producing a premium product targeting committed riders, so although you would class cycling shoes as a discretionary product, in reality, they have not acted like a discretionary product, and sales have been resilient over the current year.

“They have also avoided some of the inflation effects by being able to manufacture outside of the UK, whereas a UK-based fitted wardrobe company I also support have seen their underlying costs inflate more. Another driver contributing to why the cycling shoe brand may have bucked the trend a little this year is they began selling B2C, however, this does incur additional costs [staffing & returns] and does cannibalise your B2B sale.”

Unleashed highlighted that despite profitability concerns, the industry has cut lead times down to an average of 23.5 days, which it added was the lowest level recorded.

In June, Unleased shared that UK-based small to medium-sized clothing makers in experienced a revenue decline of 40% in the first quarter of the year.